protectionguru

31 Jul , 2024

0 Comments

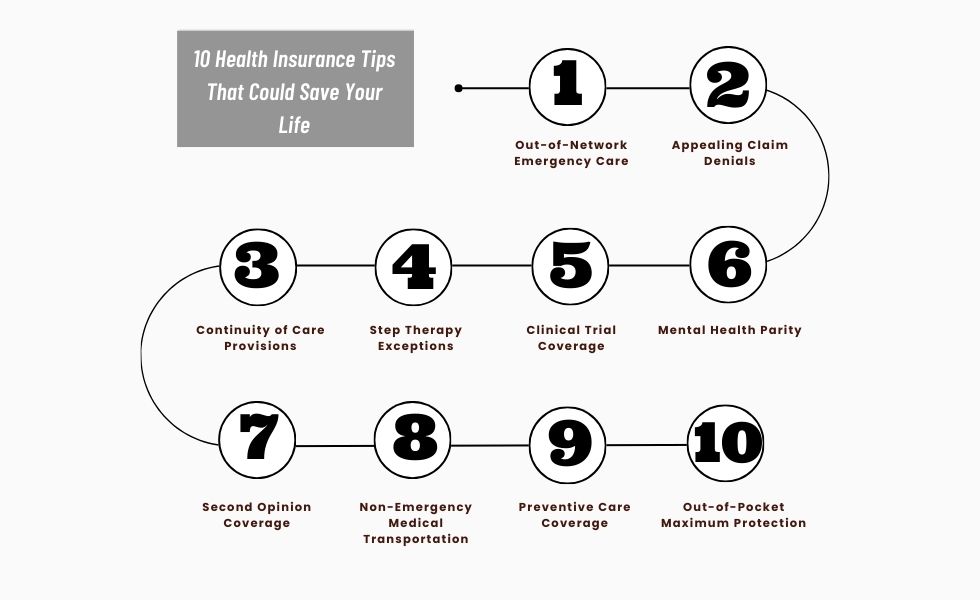

Health insurance can be confusing, but knowing a few key details can help you get better coverage and avoid unexpected costs. Here are ten important tips about health insurance that might make a big difference for you and your family.

1.Out-of-Network Emergency Care

If you have a medical emergency, your insurance should cover care at any hospital, even if it’s not in your network. This means you can go to the nearest hospital without worrying about huge bills.

Tip: In an emergency, focus on getting the care you need. Don’t worry about whether the hospital is in-network.

2.Appealing Claim Denials

Insurance companies sometimes deny claims, but you can appeal these decisions. Many denials get overturned upon review, so don’t give up if your claim is rejected.

Steps to Appeal:

- Submit your appeal within the allowed timeframe.

- Provide extra documents from your doctor.

- Consider getting help from a patient advocate.

3.Continuity of Care Provisions

If your doctor leaves your insurance network while you’re in the middle of treatment, you might still be able to see them at in-network rates for a certain time. This is important for ongoing treatments, like cancer care or pregnancy.

4.Step Therapy Exceptions

Step therapy means you have to try cheaper medications first before moving to more expensive ones. However, you can ask for an exception if you’ve already tried the cheaper drugs or if your doctor thinks they won’t work for you.

5.Clinical Trial Coverage

Insurance plans often cover routine costs for approved clinical trials. This can give you access to new treatments that might not be available otherwise.

6.Mental Health Parity

The Mental Health Parity and Addiction Equity Act requires that mental health and substance use treatments be covered similarly to physical health treatments. If you’re denied mental health care, check if this law applies to your plan.

7.Second Opinion Coverage

Most insurance plans cover second opinions, which are important for making well-informed decisions about serious health issues. Don’t hesitate to get another opinion if you’re unsure about a diagnosis or treatment plan.

8.Non-Emergency Medical Transportation

Some insurance plans, especially Medicaid, cover transportation for non-emergency medical appointments. This can be very helpful if you need regular treatments, like dialysis, and have trouble getting to appointments.

9.Preventive Care Coverage

Under the Affordable Care Act, many preventive services, like screenings, vaccines, and counseling, are covered without extra charges. These services help detect or prevent serious health issues early.

10.Out-of-Pocket Maximum Protection

Once you reach your annual out-of-pocket maximum, your insurance should cover 100% of your in-network care for the rest of the year. Keep track of your expenses to make sure you don’t pay more than you need to.

Conclusion

Knowing these health insurance tips can help you make the most of your coverage and avoid unexpected costs. Always review your policy and ask questions if you’re unsure about anything with your insurance.