protectionguru

31 Jul , 2024

0 Comments

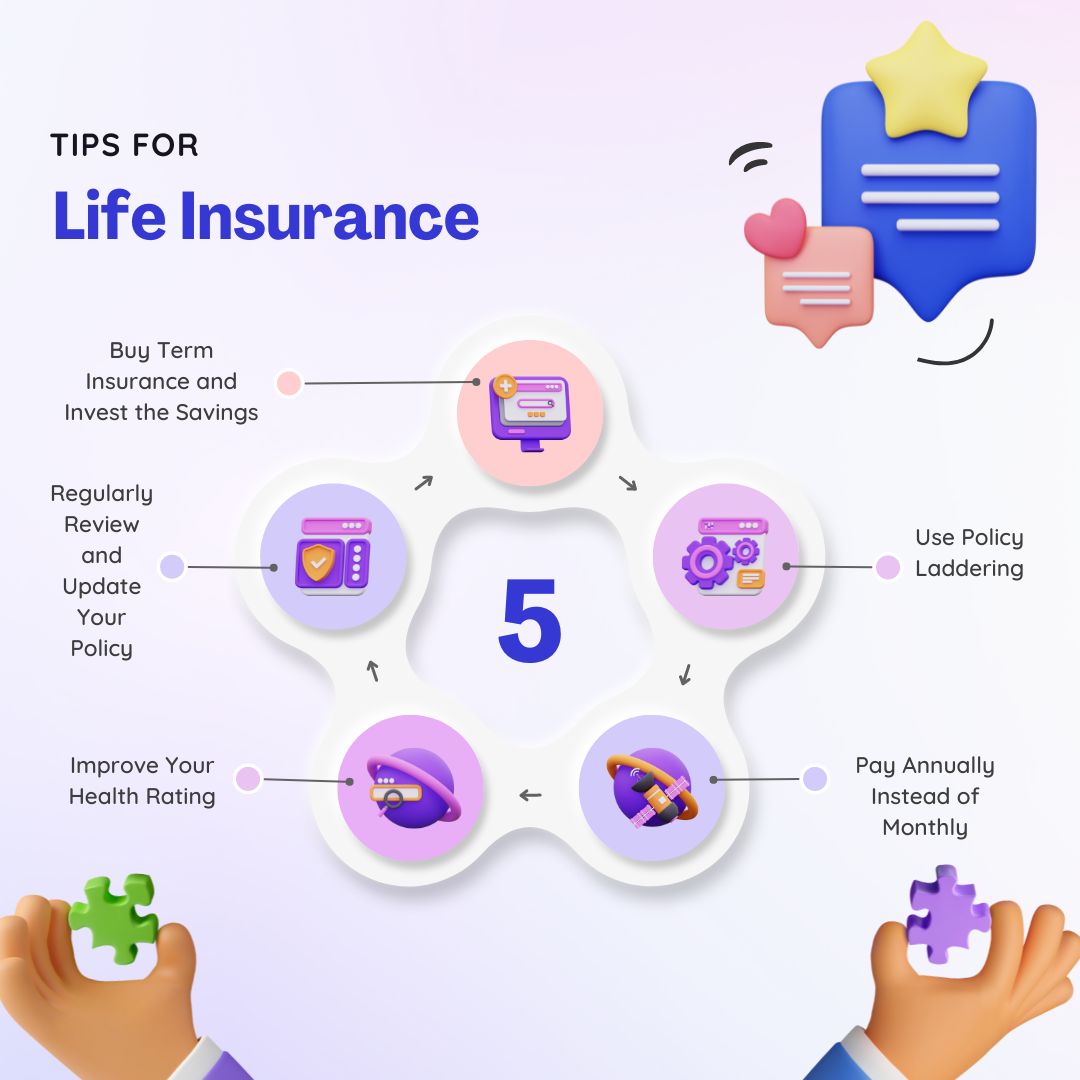

Tip #1: Buy Term Insurance and Invest the Savings

What is Term Life Insurance?

Term life insurance covers you for a specific time, like 10, 20, or 30 years. It’s usually cheaper than permanent insurance.The Investment Plan

Instead of buying a permanent policy, you can buy term insurance and invest the difference. This means you’ll pay less for insurance and hopefully grow your savings over time. This approach works well if you’re disciplined about investing.Tip #2: Use Policy Laddering

What is Laddering?

Laddering involves buying several term life insurance policies with different amounts and durations.Why Lader?

This strategy allows you to adjust coverage as your needs change. For example, you can let shorter-term policies end as your financial situation improves, saving money on premiums.Tip #3: Pay Annually Instead of Monthly

Cost Differences

Paying your premium annually instead of monthly can save you money. Although you’ll need to pay a larger amount upfront, many insurers offer discounts for annual payments.How to Save

Compare the total cost of monthly payments with the annual premium. The difference could be a significant saving over time.Tip #4: Improve Your Health Rating

Health Classifications

Insurance companies use health ratings to set your premiums. The healthier you are, the lower your premiums.How to Improve Your Rating

- Quit smoking

- Maintain a healthy weight

- Manage chronic conditions

- Exercise regularly

- Eat well

Tip #5: Regularly Review and Update Your Policy

Why Review?

Your life changes, and so do your insurance needs. Regularly checking your policy helps ensure you have the right amount of coverage.When to Update

- After big life events (marriage, divorce, children)

- When your finances change

- If your health improves

Conclusion

Using these life insurance tips could save you a lot of money. Always consider your personal needs and talk to a financial advisor or insurance expert to make the best choices for your situation.Life is what happens when you’re busy making other plans